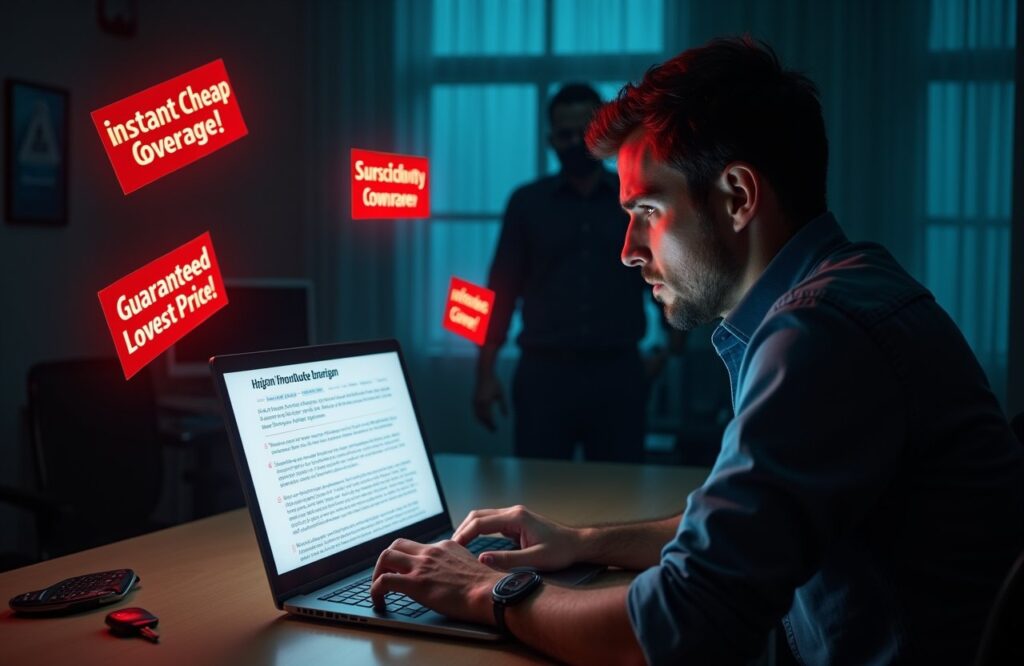

Your online car insurance policy could be worthless when you need it most.

That’s the harsh reality thousands of Michigan drivers are discovering after accidents. Insurance companies are using a new tactic to deny claims: they’re accusing customers who bought online auto insurance of fraud—even when they provided accurate information.

Here’s how it works: You buy a policy online, thinking you’re covered. Then you’re in an accident. Instead of paying your claim, your insurance company reviews your online application with a microscope, looking for any excuse to claim you committed fraud. Suddenly, that convenient online auto insurance purchase becomes the reason your claim is denied.

At The Joseph Dedvukaj Firm, P.C., we’ve seen this happen repeatedly to Michigan drivers who thought they were making a smart financial decision by getting auto insurance online. The truth is, the money you save upfront often costs you everything when you actually need coverage.

The Convenience Trap of Online Auto Insurance

The digital age has revolutionized how we buy everything—from groceries to cars to insurance. Getting auto insurance online promises:

- 24/7 availability

- Instant quotes

- Lower prices

- No pressure from salespeople

- Quick policy activation

While these benefits are real, they come with a significant downside: you’re navigating complex insurance decisions without expert guidance, and insurance companies are taking advantage of this.

How Insurance Companies Use Online Purchases Against You

The Fraud Accusation Strategy

By design, online auto insurance applications ask for minimal information upfront. However, buried in the digital fine print are pages of agreements that give insurers broad authority to claim fraud after an accident occurs. This has become the insurance industry’s preferred method for denying claims—rather than disputing your injuries or the cause of your accident, they simply claim you committed fraud when purchasing your policy online.

Common “Fraud” Claims Insurance Companies Make

Insurance companies have become increasingly creative in finding reasons to deny claims from policies purchased online. Here are the most common accusations we see:

1. Undisclosed Household Residents

Insurance carriers frequently claim they weren’t aware of other people living in your household when you purchased online auto insurance. This includes:

- Spouses who moved in after marriage

- College students returning home

- Elderly parents moving in for care

- Military children transitioning to civilian life

- Adult children who got their driver’s license

2. Misrepresented Vehicle Use

Online forms often ask vague questions about how you use your vehicle, or sometimes don’t ask at all. Later, insurance companies use this to deny claims by stating they didn’t know your true vehicle usage, including:

- Rideshare driving (Uber, Lyft, DoorDash)

- Grocery delivery services

- Using personal vehicles for work purposes

- Hauling trailers during the week and recreational use on weekends

- Any business use beyond basic commuting

3. Undisclosed Vehicle Operators

Carriers claim they weren’t properly notified about who would be driving the vehicle, even when the information was provided during the online application process.

Real-World Consequences: When Online Insurance Fails

The consequences of these claim denials can be catastrophic. Michigan’s no-fault system means you rely on your own insurance for medical bills, lost wages, and other benefits. When your insurer denies your claim based on alleged fraud from your online purchase, you could face:

- Hundreds of thousands in unpaid medical bills

- Lost wages with no compensation

- Permanent disability without support

- Legal battles that drain your savings

Our personal injury lawyers regularly represent clients who thought they had adequate coverage until they needed it most.

Why Insurance Agents Still Matter in the Digital Age

While technology has transformed many industries, insurance remains a field where human expertise is invaluable. Here’s why working with an agent protects you from the pitfalls of getting auto insurance online:

Expert Guidance Through Complex Coverage Options

Insurance agents understand Michigan’s unique no-fault system and can guide you through coverage decisions that online forms can’t explain adequately. They help you understand:

- Personal Injury Protection (PIP) options

- The impact of recent Michigan insurance law changes

- Proper liability coverage amounts

- Uninsured/underinsured motorist protection

- How different coverage choices affect your protection

Proper Documentation and Record-Keeping

When you work with an agent, every conversation and policy change is documented. This creates a paper trail that protects you if an insurance company later claims you provided incorrect information.

Ongoing Policy Management

Life changes constantly, and your insurance needs to adapt accordingly. Agents proactively help you update your policy when circumstances change, preventing coverage gaps that online customers often miss.

Michigan’s Unique Insurance Challenges

Online auto insurance is particularly risky in Michigan due to our state’s complex insurance laws. Recent changes to Michigan’s no-fault system have created new coverage options and potential pitfalls that many online customers don’t understand.

Recent Michigan Insurance Law Changes

Michigan drivers can now choose their level of PIP coverage, but making the wrong choice could leave you financially exposed. Online platforms often don’t adequately explain these options or their long-term implications.

The Importance of Unlimited PIP Coverage

While getting auto insurance online might steer you toward cheaper, limited PIP options, unlimited coverage is often the safest choice. The medical costs from serious auto accidents can easily exceed lower coverage limits, leaving you responsible for the difference.

Red Flags When Buying Online Auto Insurance

Watch out for these warning signs that suggest an online insurance purchase might leave you vulnerable:

Minimal Questions About Your Situation

If the online application doesn’t ask detailed questions about:

- All household members

- How you use your vehicle

- Your driving history

- Other insurance policies

This could indicate the company plans to use missing information against you later.

Pressure to Complete Purchase Quickly

Online platforms often create artificial urgency to prevent you from researching or comparing options thoroughly. Take time to understand what you’re buying.

Unclear Policy Language

If you can’t easily understand what’s covered and what isn’t, don’t assume you’ll figure it out later. Confusion during purchase often leads to coverage disputes after accidents.

Protecting Yourself When You Need Insurance Coverage

Whether you’ve already purchased online auto insurance or are considering it, here are steps to protect yourself:

Document Everything

- Save all communications with your insurance company

- Keep records of any policy changes or updates

- Take screenshots of online forms and confirmations

- Maintain copies of all policy documents

Review Your Policy Annually

Don’t just set it and forget it. Review your coverage annually to ensure it still meets your needs and that all information is accurate.

Update Your Policy Promptly

When life changes occur, contact your insurance company immediately to update your policy. This includes:

- Marriage or divorce

- New drivers in the household

- Changes in vehicle use

- Moving to a new address

- Changes in employment that affect driving

Consider Legal Review

If you have questions about your coverage or have been involved in an accident, contact us for a free consultation. We can review your policy and help ensure you’re protected.

What to Do if Your Online Insurance Claim is Denied

If your insurance company denies your claim based on alleged fraud from your online purchase, don’t accept their decision without fighting back. Here’s what you should do:

1. Document the Denial

Get the denial in writing and understand exactly why they’re refusing to pay your claim.

2. Review Your Original Application

Compare what you submitted online with what the insurance company claims you didn’t disclose.

3. Gather Supporting Evidence

Collect any documentation that supports your position, including emails, screenshots, and witness statements.

4. Consult with an Attorney

Insurance fraud allegations are serious, and you need experienced legal representation to protect your rights.

The True Cost of “Cheap” Online Insurance

While online auto insurance often appears cheaper upfront, the real cost comes when you need coverage most. Consider these factors when evaluating insurance costs:

False Economy of Low Premiums

The cheapest policy is worthless if it doesn’t pay when you need it. A slightly higher premium with better coverage and service is always the better investment.

Hidden Costs of Claim Denials

When your online insurer denies a claim, you face:

- Legal fees to fight the denial

- Out-of-pocket medical expenses

- Lost wages during coverage disputes

- Potential financial ruin from large claims

Long-Term Financial Impact

A major accident without proper insurance coverage can affect your finances for decades. The money you save on premiums pales in comparison to potential losses.

Questions to Ask Before Buying Auto Insurance

Whether buying online or through an agent, ask these critical questions:

- What exactly is covered under each type of coverage?

- What are the specific exclusions and limitations?

- How do I properly update my policy when circumstances change?

- What happens if I need to file a claim?

- How does this coverage coordinate with other insurance policies?

- What are the consequences of choosing lower coverage limits?

Conclusion: Making Informed Insurance Decisions

While online auto insurance offers undeniable convenience, the potential costs far outweigh the benefits for most Michigan drivers. The complexity of Michigan’s no-fault system, combined with insurance companies’ increasing use of fraud allegations to deny claims, makes expert guidance more valuable than ever.

Before purchasing insurance online, consider the long-term consequences of that decision. A few minutes of convenience today could lead to years of financial hardship tomorrow.

If you’ve already purchased online auto insurance and are concerned about your coverage, or if you’ve been injured in an accident and your online insurer is denying your claim, don’t wait to get help.

The experienced attorneys at The Joseph Dedvukaj Firm, P.C. are here to protect your rights and fight for the compensation you deserve.

Call us today at 866-HIRE-JOE for a free consultation.

Don’t let insurance companies take advantage of gaps in your online policy. We’ll review your coverage, explain your rights, and fight to ensure you receive the full benefits you paid for.